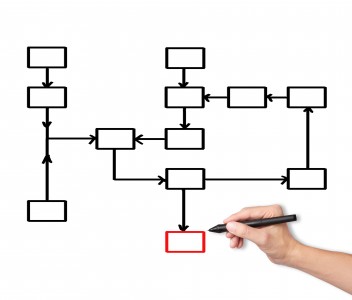

Audit practice either domestically or internationally is stricktly regulated by different national and international organizations. In Spain the regulatory body is the Institute of Accounting and Audit, which reports to the Ministry of Economy and Competitiveness Link: http://www.icac.meh.es/ An Audit consists of the review and verification of annual accounts and other financial statements or accounting documents prepared under the applicable regulatory financial reporting framework. This activity is aimed at issuing a report assessing the reliability of these documents for any interest third parties may hold against your company. The financial statements audit verifies those accounts in order to rule whether a true and fair valuation of the assets, financial position and results of the audited entity has taken place in accordance with the regulatory financial reporting framework that is applicable. It shall also cover, if necessary, verification of the management report accompanying the financial statements in order to assess its agreement with the aforementioned financial statements and whether their content is in accordance with the provisions of the applicable legislation. With the aim of defining the processes which will ensure both, proper documentation & correct valuation, BTC-Guardian Auditors with a long track record of success, will collaborate with your organization as well as with your organization’s auditor. Our goal is to install confidence with your business owners and management and make them feel comfortable with all new implemented bitcoin related processes and tools, at the same time as your auditor. BTC-Guardian offers regular and timely review of its bitcoin technology related processes, ensuring their compliance with all applicable regulation. We will propose, if necessary, appropriate recommendations to mitigate potential risks.

– Compliance –

– Compliance –